WORK

Bench Tax

Designing a unified platform to streamline workflows and improve UX.

MEDIUM

UX, UI

DELIVERABLES

Product & Service Design

PROJECT ROLE

Lead Product Designer

Project overview:

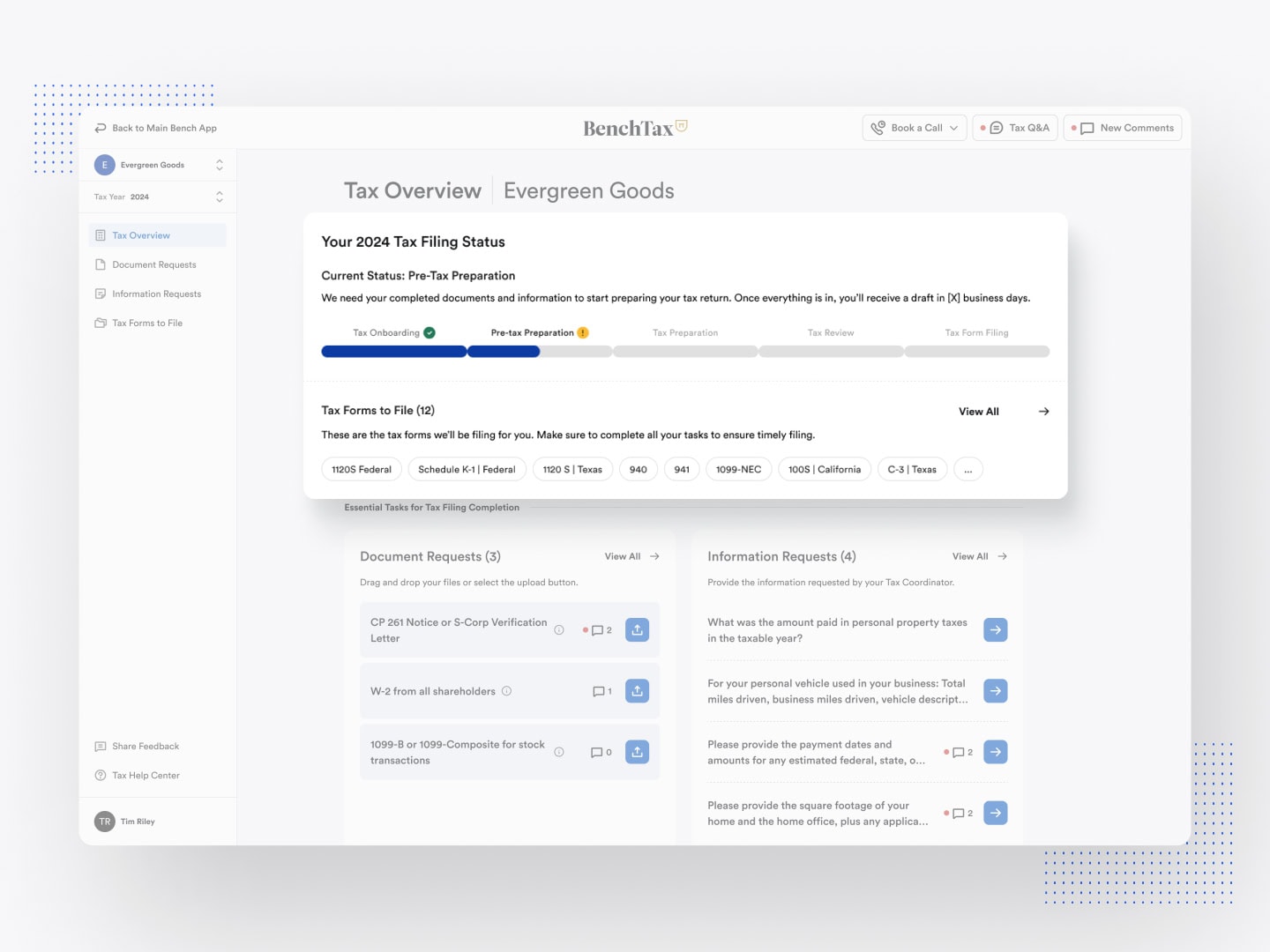

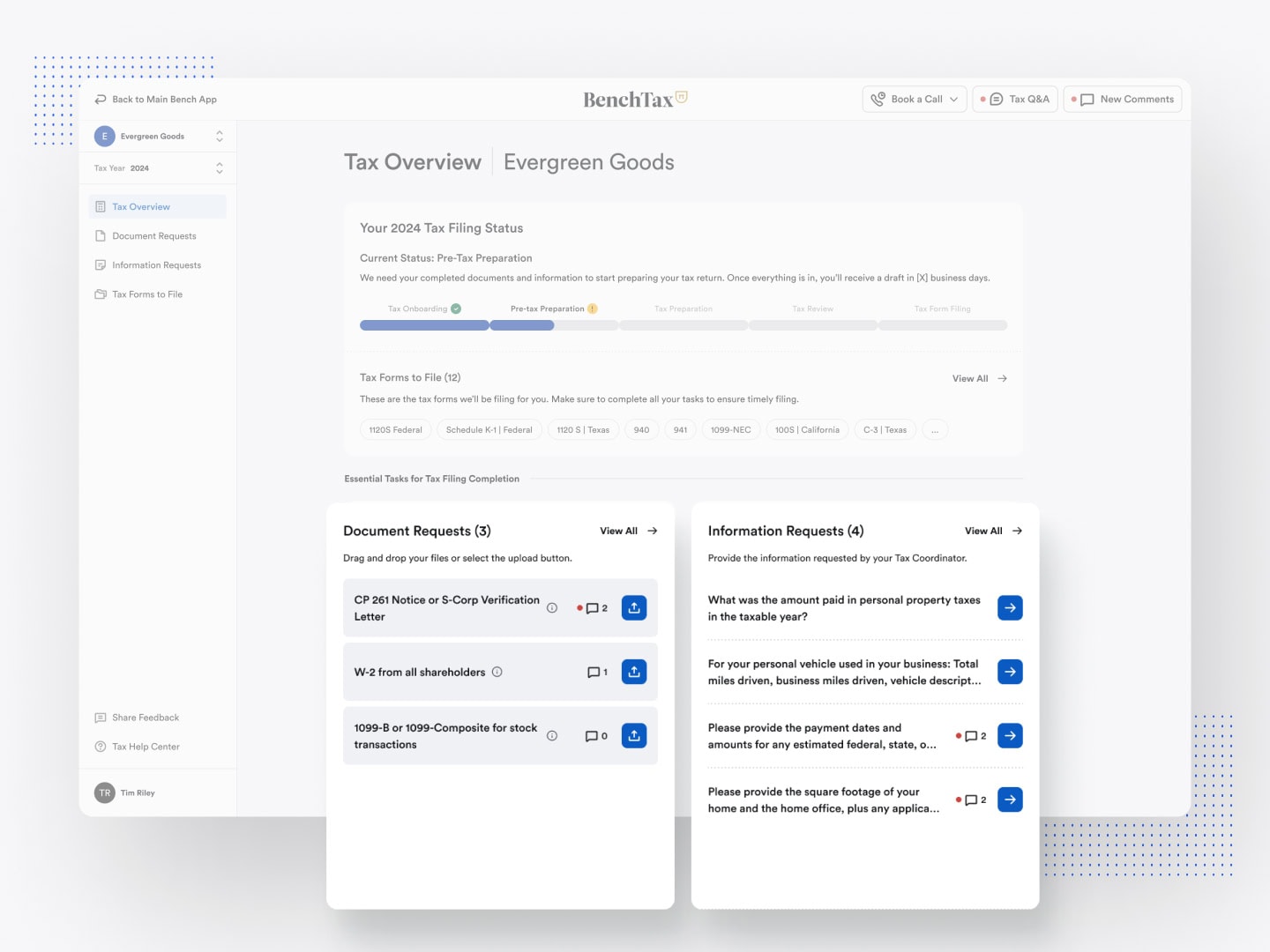

As the Lead Product Designer for Bench Tax, I worked closely with the Product Manager, the internal Tax Team, and a dedicated contract engineering team to design a seamless and unified customer-facing tax portal within the Bench app. My role involved leading UX discovery, mapping out service blueprints, and delivering detailed, high-fidelity designs. Through this process, I bridged gaps between internal workflows and customer-facing touchpoints to create a seamless tax experience.

Bench Tax was designed to create an integrated tax filing experience for Bench customers by transitioning from the third-party platform, Karbon, to an in-house solution. This project aimed to resolve customer pain points like unclear task requirements, fragmented communication, and ineffective document management. The goal was to enhance customer satisfaction, reduce churn, and improve operational efficiency for the Tax Team through a unified and transparent tax management platform.

Customer Problems:

“I realized on the 15th that I had been asked to approve a draft return 8 days earlier! But I had never seen it. I really expected better from this experience.”

Lack of Task Clarity:

- Customers were often unclear about what tasks they needed to complete and why, leading to delays and frustration.

“I just want to know where things stand. I feel like I’m left in the dark about my tax filing process.”

Lack of Visibility into Tax Filing Status:

- Customers felt disconnected from the process, with limited transparency on progress or required actions.

“I would prefer if the same app was used throughout the experience, maybe a tax portal within the bench app so I can have everything accessible.”

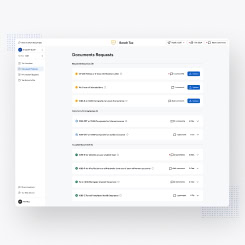

Ineffective Document Management:

- Today, Customers have multiple places to upload documents, often having to provide the same ones already submitted for bookkeeping, and previously uploaded documents are not easily accessible.

“Communication isn’t great, questions not answered quickly, multiple reminder emails after a task is already complete, late filing.”

Communication Challenges:

- Customers had to interact with multiple team members across different communication channels, resulting in confusion and delays.

Business Problem:

Bench’s existing tax filing process, which relies on the third-party platform Karbon, is fragmented and inefficient. This disjointed system results in multiple communication channels, inconsistent document management, and unclear task expectations. These issues frustrate customers, lead to slow response times, and create a lack of transparency regarding their tax filing status. Both customers and the Tax Team face significant challenges, including operational inefficiencies that harm the overall user experience and Bench’s reputation. These pain points contribute to increased customer churn, reduced satisfaction, and added strain on the Tax Team. Developing an integrated tax portal within the Bench app is essential to address these issues, streamline workflows, and provide a seamless experience for both customers and the team.

How might we create a seamless tax experience for customers that consolidates communication, document management, and task tracking, while addressing the frustration caused by the current disjointed processes?

Hypothesis:

By creating a unified tax platform that streamlines communication, document management, and task tracking, we have the opportunity to significantly enhance the customer experience. This solution aims to reduce frustration, enhance satisfaction, lower churn rates, and boost operational efficiency for both customers and the Tax Team. By providing greater clarity and accessibility, the tax filing process becomes more seamless and transparent, fostering stronger customer trust, improved retention, and long-term business growth.

Objectives

- Create a Unified Tax Experience: Develop an integrated platform for all tax-related interactions to streamline customer engagement and simplify processes.

- Enhance Communication and Clarity: Ensure that task requirements and deadlines are clearly communicated to customers, improving understanding and reducing delays.

- Increase Customer Satisfaction and Retention: Address key pain points to foster loyalty, reduce churn rates, and create a more positive user experience.

- Boost Operational Efficiency: Minimize redundant tasks for the Tax Team, enabling them to focus on delivering quality service and building stronger client relationships.

What We’ll Measure:

- Churn Reduction Percentage: Achieve a 0.3% decrease in early churn rates among new customers, significantly impacting tax revenue.

- Operational Time Savings: Reduce repetitive tasks for the Tax Team by 5,038.2 hours, translating to an estimated $115,879 in operational savings.

- Customer Satisfaction Scores: Monitor customer feedback through satisfaction ratings and reviews to measure improvements in the tax filing experience.

- Customer Growth Rate: Increase the number of new tax customers, aiming for 1,905 by the end of FY2024.

Design process:

This project was initiated as a continuation of a prior tax-season solution: a Jotform questionnaire to collect customer tax information. While this was a step up from the earlier manual process of tax coordinators calling customers to gather information, it exposed significant pain points around scalability, usability, and team efficiency.

To kick things off, I reviewed the business case presented by the Product Manager to understand the core problems and opportunities for improvement. Collaborating with the Tax Team, we delved into their workflows and identified pain points to gain a clear understanding of their needs. This collaborative foundation helped set the stage for the discovery phase.

Discovery

The process began with market research and competitive analysis to understand how other platforms streamlined tax management. I reviewed user flows of competing tax solutions, identifying best practices and opportunities to address customer pain points.

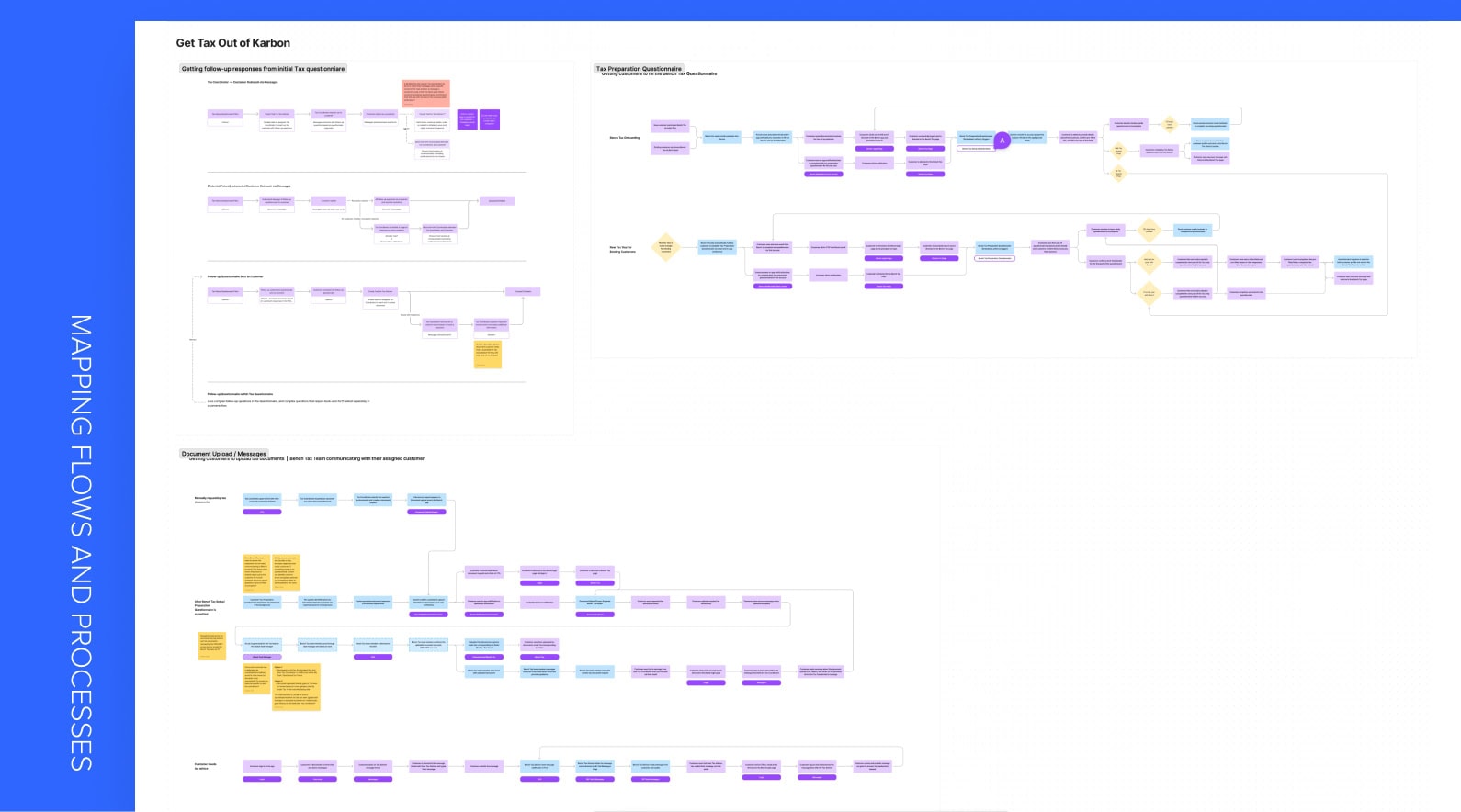

Mapping Flows and Processes

I mapped out existing customer workflows and internal processes. By identifying bottlenecks and inefficiencies in the current system, I was able to pinpoint areas where design intervention could provide the most value.

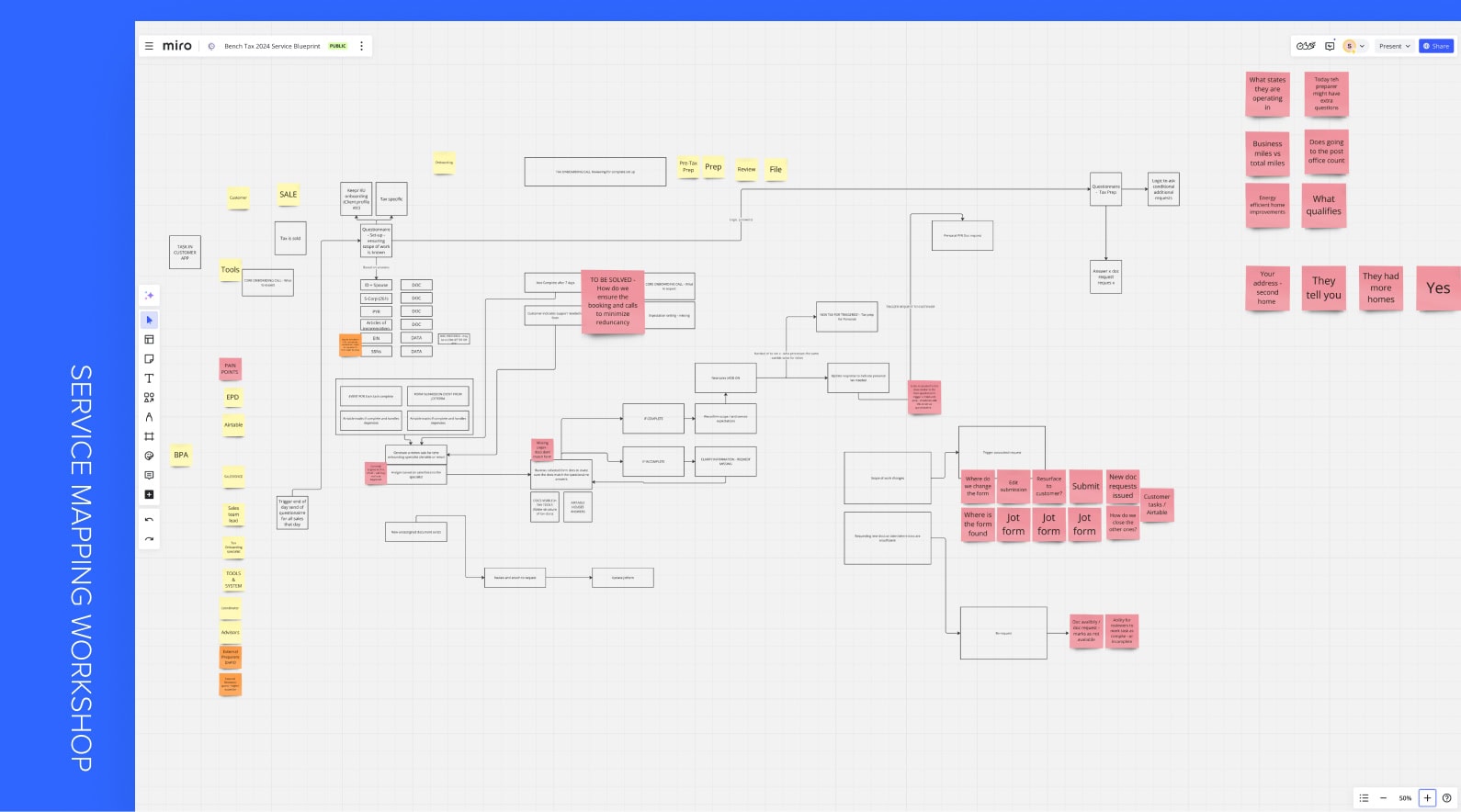

Service Mapping Workshop

To gain deeper insight, we facilitated a Service Mapping Workshop with the Bench Tax Team. Together, we charted the end-to-end tax filing process, uncovering critical pain points for both customers and the team. This exercise laid the foundation for designing a system that worked seamlessly for all stakeholders.

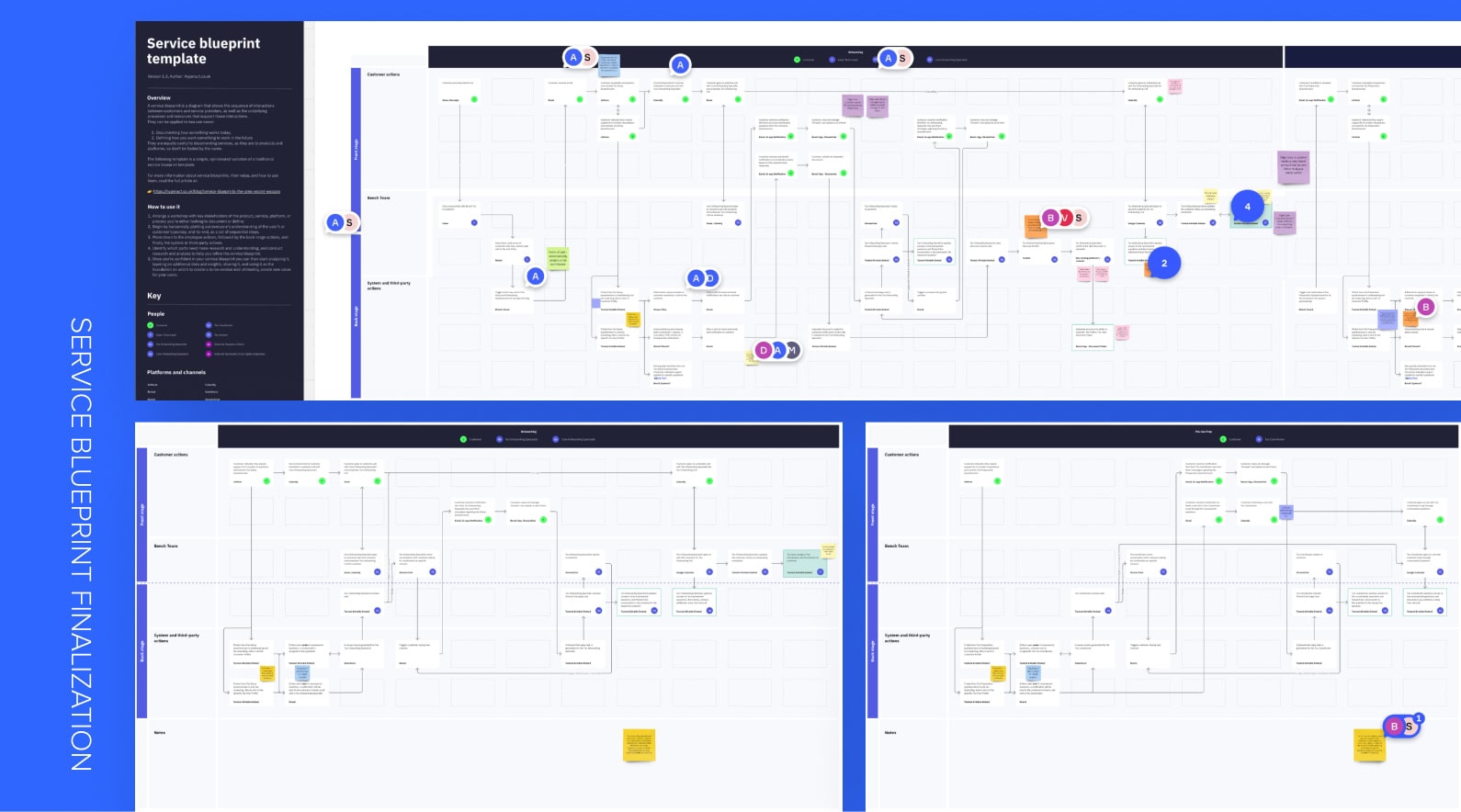

Service Blueprint Finalization

Using insights from the workshop, we created a Service Blueprint to visualize the entire tax filing process. This blueprint served as a reference document for stakeholders, highlighting key workflows, potential bottlenecks, and areas for improvement. Iterative feedback from the Tax Team ensured that the blueprint addressed real-world challenges, including edge cases and operational nuances.

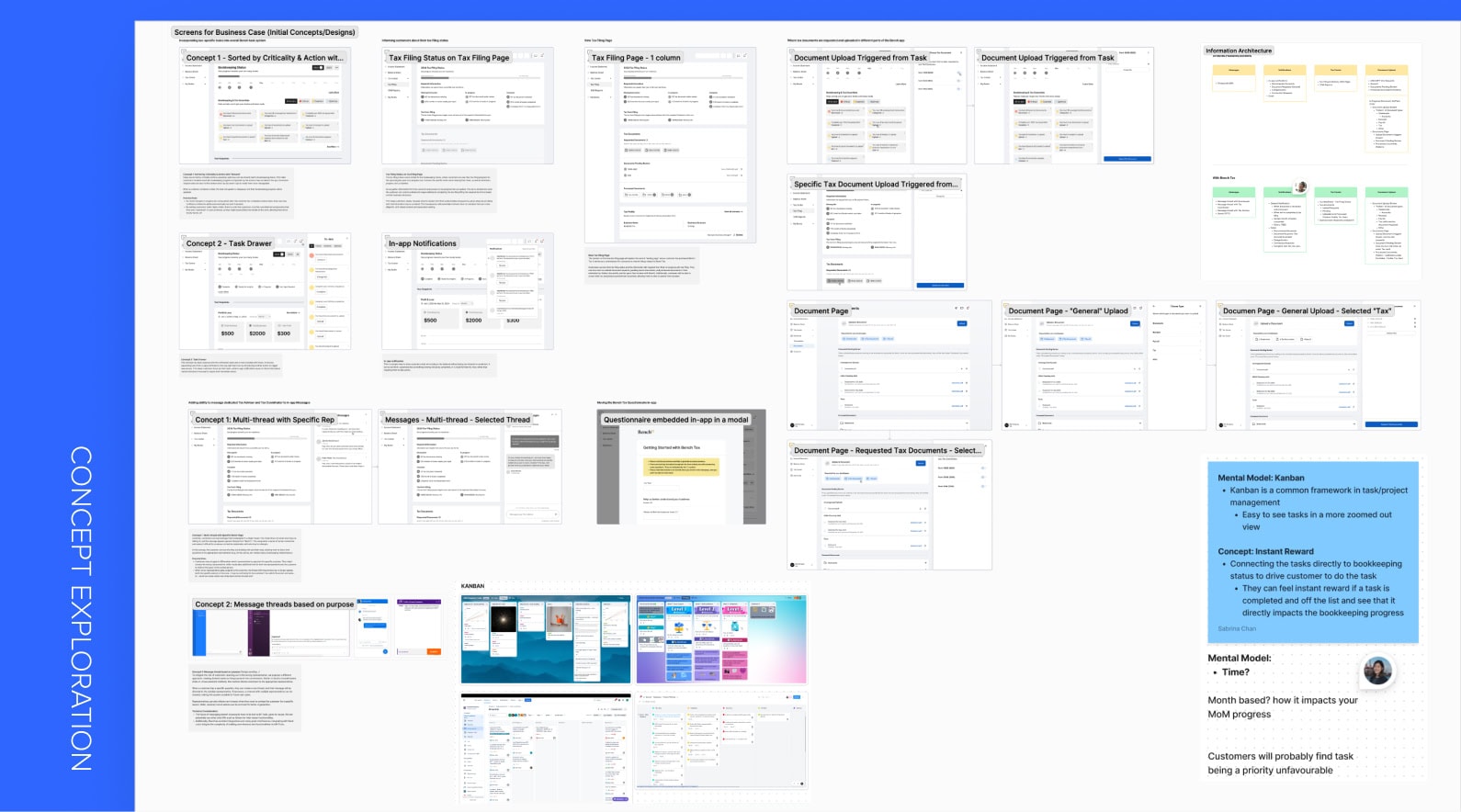

Concept Exploration

With the service blueprint finalized, I explored various design concepts and mental models for structuring the tax process. These ideas were shared with the team to gather input and ensure alignment on the direction of the project.

Wireframing

Based on customer pain points and the team’s requirements, I developed low-fidelity wireframes to outline the core user flows. Each wireframe focused on solving specific problems, such as task clarity, document accessibility, and streamlined communication. Regular reviews with the engineering team ensured feasibility, while feedback from the Tax Team helped refine the designs.

Prototyping

I developed an interactive prototype based on the finalized wireframes. The prototype allowed stakeholders to experience the user flow firsthand, offering a practical way to test and validate functionality before moving into development. Usability testing with the Tax Team helped identify areas for improvement, ensuring the design met both customer and team needs.

Delivery

The final stage involved creating high-fidelity designs with detailed annotations and design specifications for the development team. Every interaction, behavior, and edge case was meticulously documented to streamline the handoff process. Close collaboration with engineers during implementation helped address any questions and ensured the final product aligned with the design vision.

Outcome:

Key takeaways:

Collaboration and iteration are key to uncovering complexities.

The project emphasized the value of close collaboration with the Tax Team during the Service Mapping Workshop, where we uncovered hidden complexities in their workflow. These insights guided the design of a system that addressed both customer pain points and operational challenges, showcasing how iterative collaboration can lead to better user-centered solutions.

The service blueprint became a shared vision for stakeholders.

The Service Blueprint proved essential in aligning all stakeholders and visualizing the end-to-end experience. It became the backbone of the design process, ensuring that everyone from the Tax Team to the PMs was on the same page about the user journey and operational flow.

Thoughtful design can transform fragmented processes into cohesive solutions.

The success of the Bench Tax project highlights how careful design can turn fragmented processes into a cohesive, customer-focused solution. By simplifying and streamlining the tax filing experience, we were able to improve operational efficiency and customer satisfaction, reinforcing the impact of user-centered design.

Credits:

Lead Product Designer: Sabrina Chan (Senior Product Designer)

Lead Product Manager: Arthur Davis (Product Manager)

Contract Engineering Team: Rappid